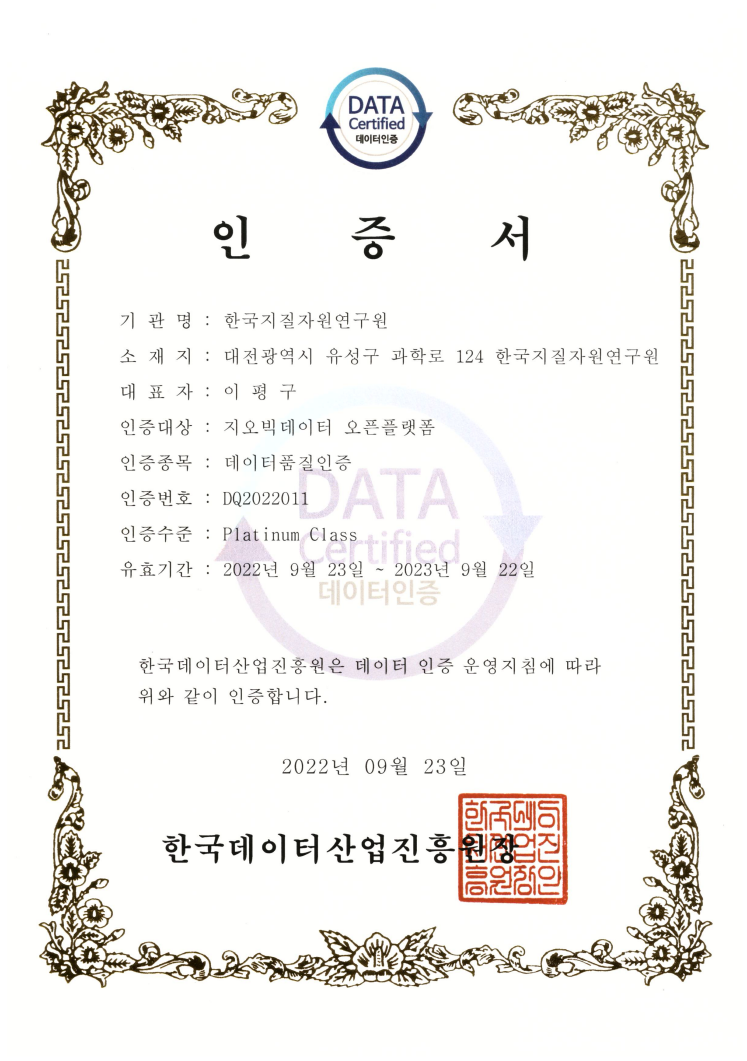

데이터 품질 인증서

| 자료유형 | KIGAM 보고서 |

|---|---|

| 제목 | 니켈의 국제수급구조분석 및 안정공급방안 연구 |

| 저자 | 김영인 |

| 언어 | KOR |

| 청구기호 | KR-98-C-43.1-1998-R |

| 발행사항 | 韓國資源硏究所, 1998 |

| 초록 | In the case of resource-poor Korea, which relies on imports for 100% of its nickel, nickel imports have risen from 2,306 MT in 1984 to 19,069 MT in 1997, making Korea now the fifth largest consumer in the world. To secure a stable source of inexpensive nickel, we must analyze the status of overseas nickel industry, the supply-demand structure, the multilateral trade, the diversification of nickel import contract methods such as long, short, spot contracts, and the development import of overseas nickel mines, nickel refineries and nickel smelters. It is also necessary to study all of these methods of securing nickel separately. The world's nickel reserve is over 40mill.MT, over 87% of reserve is concentrated in Russia(16.5%), Cuba(13.8%), Canada (13.3%), New Caledonia (11.3%), Australia (9.3%), China(9.3%), Indonesia (8%), South Africa (6.3%). World mine production reached a peak of over 1,029 thousand MT in 1996. The total world production of nickel is projected to be from 1,022 thousand MT in 1997 to 1,140 thousand MT in 2002 with an annual average growth rate of 2.2% for the period. Nickel consumption is projected to increase from 974.5 thousand MT in 1997 to 1,076 thousand MT in 2002 with an annual average growth rate of 2% for the period. Nickel consumption in Korea will increase from 64,867 MT in 1997 to 71,618 MT in 2002 with an annual average growth rate 2% for the period. The main end-use for nickel will be stainless steel industry(89%), special steel(2.7%), alloy(3.5%), casting(2.5%), and electroplating(2.3%).The international nickel price is influenced by variable such as nickel production, consumption, the size of nickel stocks, the exchange rate (Yen/$), the US prime rate, oil prices, crude steel production, aluminium prices, copper prices and so on. The model of international aluminium price induced from the time series multi-regression analysis by the forward stepwise method is as follows: Y = -3332.49 + 4.58*(aluminium price) + 2.79(copper price) R-square = 0.75. F=25.3. It is important to review the optimal equity purchase rate of overseas nickel mines, refineries and smelters. So, to calculate the appropriate purchase rate to be induced from the portfolio theory, three variables of yearly time series are necessary to be consider: the import unit price, the production unit cost, and the international price.We can derive expected returns and variances of them in the international price comparison with production unit cost and the import unit price. Rational investors, if there are any, have a tendency to seek high expected returns and to mitigate risk at the same time. The appropriate purchase rate induced form the theory is approximately 26 percent, in which many factors outside of the economy are not taken into consideration. So up to the level of 26 percent, the government is expected to have a supporting policy for the active development of overseas nickel mines, refineries and smelters |

| 페이지 | vii, 247 p. |

| 키워드 | 니켈, 국제수급, 수급, 공급 |

| 원문 |

http://library.kigam.re.kr/report/1998/니켈의국제수급구조분석및안정공급방안연구.pdf |

댓글